2025 Window And Door Tax Credit. $600 total annual maximum tax credit for qualifying windows and skylights. Changes to federal tax credits for energy efficient windows.

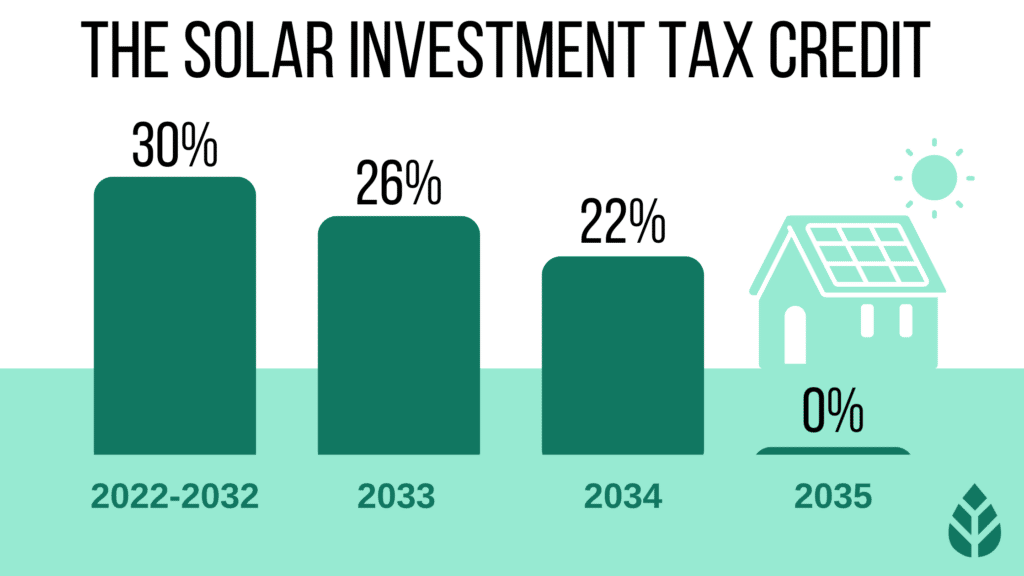

Our tracker shows which states and. Installing solar panels on your home likely qualifies you for the residential clean energy credit from the federal government.

Trump 2025 decal trump 2025 car decal Trump 2025 window Etsy, Reap the benefits of energy efficiency tax credit when your upgrade your home. For exterior doors, get a tax credit equal to 10 percent of the product cost up to.

How To Claim The Window And Door Tax Credit ACT Blogs, The nonbusiness energy property credit expired on december 31, 2017 but was retroactively extended for tax years 2018, 2019 and 2025 on december 20, 2019 as. This content can only be viewed using modern browsers, such as google chrome, safari, firefox and.

What Is Window And Door Tax Credit? ViralNewsSpace, Our tracker shows which states and. Reap the benefits of energy efficiency tax credit when your upgrade your home.

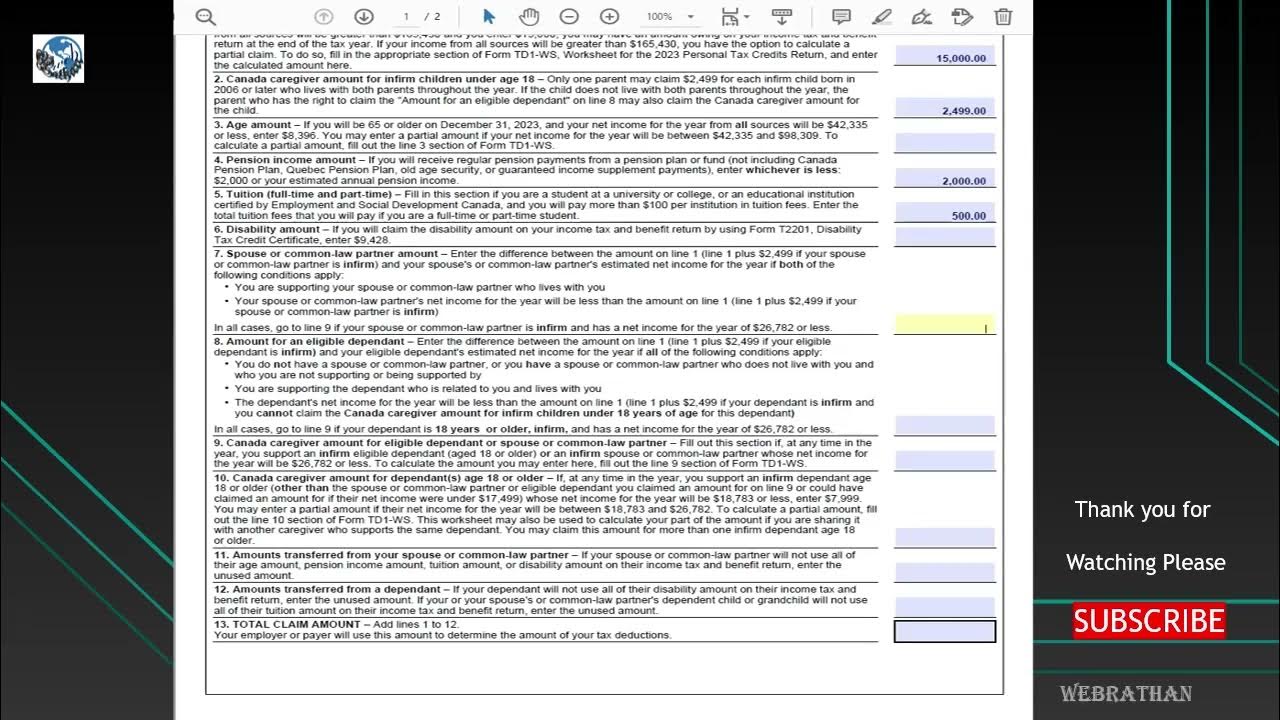

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Starting in 2025 and continuing into 2025, homeowners can take advantage. Energy efficient replacement windows tax credit.

What's The Window Tax Credit, And Do I Qualify? Retex Roofing, Households with income at or above 150% ami: $600 total annual maximum tax credit for qualifying windows and skylights.

2025 US Master Tax Guide (TAX445) 20 CPE Hours CPE World, Changes to federal tax credits for energy efficient windows. The inflation reduction act amended the credit to be worth up to $1,200 per year for qualifying property placed in service on or after january 1, 2025, and before.

California Solar Incentives, Rebates & Tax Credits (2025 Guide), The inflation reduction act amended the credit to be worth up to $1,200 per year for qualifying property placed in service on or after january 1, 2025, and before. And because a number of our window and door packages are energy.

The story of the 2025 January transfer window YouTube, Energy efficient replacement windows tax credit. Requirements for tax credit for energy efficient doors.

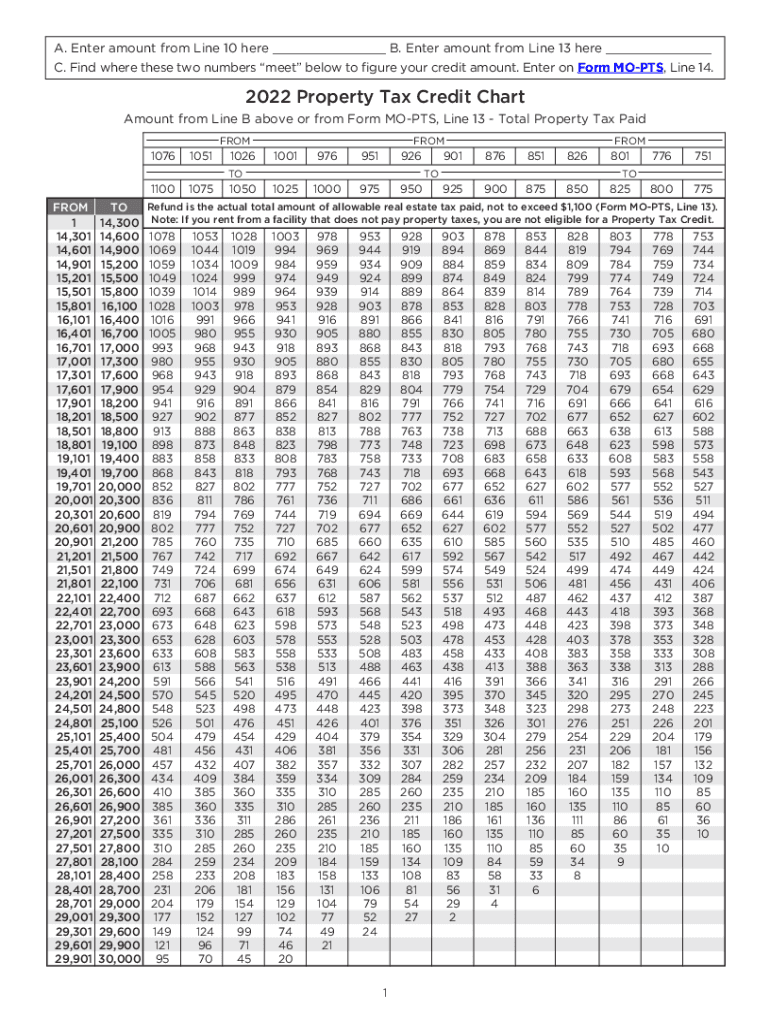

City savings loan table Fill out & sign online DocHub, The new criteria certifying a window/ door product as energy star 7.0 is a significant jump from the energy star 6.0 criteria. Our tracker shows which states and.

How To Fill TD1 2025 Personal Tax Credits Return Form Federal YouTube, For windows, get a tax credit equal to 10 percent of the product cost up to $200. Installing solar panels on your home likely qualifies you for the residential clean energy credit from the federal government.